Economists at the Center for Agricultural and Rural Development at Iowa State University have issued a new policy brief that measures the revenue impacts the COVID-19 outbreak is having on some of Iowa's largest agricultural industries. Estimates show overall annual damage of roughly $788 million for corn, $213 million for soybean, over $2.5 billion for ethanol, $658 million for fed cattle, $34 million for calves and feeder cattle, and $2.1 billion for hogs.

Introduction

The 2019 COVID-19 outbreak, in terms of the suddenness of onset, the communicability of the disease, and its immediate stress on market and health infrastructure, is the most far-reaching public health crisis the United States has faced. For the first time in U.S. history, governors of all states and four U.S. territories have declared statewide emergencies, and 52 states and territories have deployed the National Guard.

1The speed and scope of the deadly outbreak is devastating, and not just from a health perspective. As countries around the world have sought to limit the spread and severity of COVID-19 outbreaks, many have set up temporary policies to prevent or slow the transmission of the disease. Most of these policies revolve around social distancing — creating space between individuals to limit transmission. With COVID-19, public health officials have stressed a six-foot buffer zone around non-healthcare, non-household individuals. To enforce social distancing, governments have urged, and in several cases ordered, citizens to stay at home, only allowing trips for basic and necessary supplies and services. State governments have also regulated the shutdown or slowdown of non-essential businesses, for which each state determines its own definition.

These policies appear to work in reducing the rate of infection, but they severely curtail economic output and restrict demand. They also force significant changes in the ways people obtain and use basic goods and services. Agriculture is one of many sectors reshaping itself in order to function in this new economic environment. Iowa’s crop industries depend on three major uses: livestock feed, biofuels, and international sales. International sales fulfill other countries’ food, feed, and fuel needs; thus, we concentrate on how the COVID-19 outbreak has affected food, feed, and fuel use.

The easiest impact to see is on fuel, and therefore biofuel, use. With the imposition of “stay-at-home” or “shelter-in-place” orders, U.S. fuel usage has plummeted to 50 year lows (per person), and the Energy Information Agency (EIA) is expecting global fuel usage to fall through the second quarter of 2020. The severe cut in fuel demand has led to sizable reductions in fuel prices, ballooning fuel stocks, and the need for dramatic cuts in fuel production.

2However, these changes have a ripple effect on other segments of the economy. The idling of some ethanol plants and the slowdown at others not only reduces ethanol production, it also limits the supply of distillers grains, a major livestock feed component. For some livestock producers, this has translated into higher distillers grains prices as supplies are small, and for some producers, no longer available.

As distillers grains have disappeared from the feed ration, livestock producers must replace the energy and protein previously provided by distillers grains. Thus, livestock producers are shifting their feed rations to replace distillers grains with other available feed ingredients, typically soybean meal (for protein) and corn (for energy).

At the same time, the food segments of agricultural markets are transforming to meet food needs, while limiting social interaction. Since 2014, Americans have spent a little over half of their food expenditures on food eaten away from the home. 3On March 17, Governor Reynolds ordered restaurant dining rooms closed. Some restaurants transitioned to carry-out only, while others have been forced to shut down. With the restaurant closures, at-home food consumption has increased significantly, putting the strain on grocery stores, supermarkets, and other food retailers as consumers stock up.

With nearly half of food previously being sold outside of the grocery/retail sector, farm supplies cannot simply be sent to a sector that does not have either the space nor refrigeration and transportation capacity to immediately take the products, despite the demand. Consumers see empty shelves in retail stores because prior to the COVID-19 outbreak, about half their food was purchased elsewhere. As people shelter at home and adjust to the limitations of restaurant carry-out, there have been very quick, dramatic shifts in food purchase and consumption patterns.

While agricultural supply chains are somewhat nimble, the quick shift has created surpluses in some food products and shortages in others, especially in the repackaging and delivery of items that previously shipped to restaurants. Obviously, the logistics will take time.

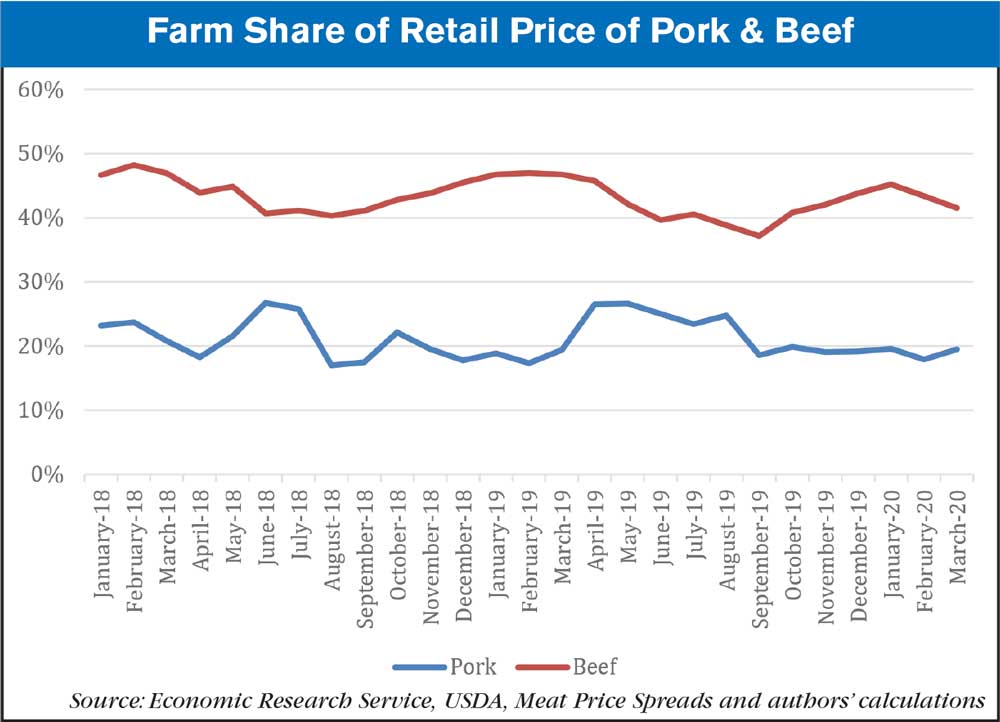

One concern is whether food retailers are taking advantage of the pandemic by either raising prices to consumers or lowering prices paid to suppliers. Accordingly, U.S. senators have asked for an investigation into excessive margins. 4Researchers know that U.S. Department of Agriculture margins are an inefficient method of determining whether firms in a supply chain exert atypical market power. In fact, the margins themselves can be problematic, especially when compared over long time periods.

5Nevertheless, the monthly margins created by USDA can be instructive when measured over short periods of low inflation is low and there are no significant changes to consumption or technological changes to production. The figure below shows that the percent of retail value for beef and pork returning to the farmer do not appear to be significantly different in February and March of 2020 than they were in 2018 or 2019. However, we are still early in the pandemic, and as the months pass and data become available, more sophisticated techniques should be used to assess the changes.6

The full paper is available at https://www.card.iastate.edu/products/policy-briefs/display/?n=1301

1 National Governors Association, https://www.nga.org/coronavirus/#states last accessed 4/13/2020.

2 WTI Crude has fallen from an average of $57/barrel in 2019 to $29.34/barrel today and U.S. gasoline prices have fallen from an average of $2.60/gal in 2019 to $1.86/gal today. Source: US Energy Information Administration https://www.eia.gov/outlooks/steo/, last accessed 4/13/2020.

3 Saksena, M.J. et al. 2018. American’s Eating Habits: Food Away From Home. EIB-196. Economic Research Service, USDA, September 2018 https://www.ers.usda.gov/webdocs/publications/90228/eib-196_ch3.pdf?v=8116.5, last accessed 4/13/2020.

4 Polansek, T. “U.S. senators scrutinize meat packers' big profits during pandemic.” Reuters. 3/30/2020. https://www.reuters.com/article/us-health-coronavirus-usa-meatpacking/u-s-senators-scrutinize-meat-packers-big-profits-during-pandemic-idUSKBN21H38M, last accessed 4/1/2020.

5 Pouliot, S. and L. Schulz. 2016. "Measuring Price Spreads in Red Meat," Agricultural Policy Review: Vol. 2016: Issue 1, Article 5. https://lib.dr.iastate.edu/agpolicyreview/vol2016/iss1/5 .

6 See for example Crespi, J.M. and R.J. Sexton. “A Multinomial Logit Framework to Estimate Bid Shading in Procurement Auctions: Application to Cattle Sales in the Texas Panhandle.” Review of Industrial Organization 27(2005): 253-278, and Crespi, J.M. and R.J. Sexton. “Bidding for Cattle in the Texas Panhandle.” American Journal of Agricultural Economics 86(2004): 660-674.