Five of the world's largest crop protection companies are investing billions into the research and development of biological products, and an analysis of the expenditures predicts the investments will make billions in return.

No-tillers should care about investments into biologicals because government regulation and consumer demand are restricting chemical use, and biologicals are new chemical-free tools, according to Mark Trimmer and Rick Melnick at bio-industry market research company DunhamTrimmer. Trimmer and Melnick say most biological innovation still comes from small companies, but they need resources from larger companies and investors to keep technology from "dying on the vine."

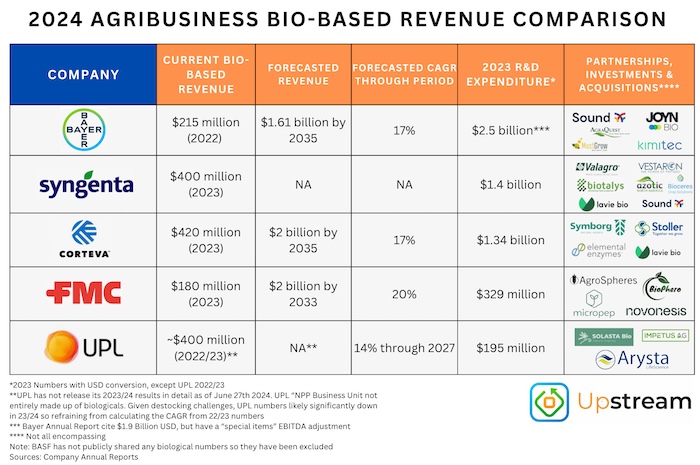

The big crop protection companies also need the smaller companies for biological offerings. None of the big crop protection companies have strong biological research and development, Trimmer and Melnick say. Shane Thomas, agronomist and author of the Upstream Ag Insights weekly agribusiness newsletter, predicts that isn't likely to change anytime soon, as these companies are taking the approach of partnering, investing and acquiring with biological makers, rather than developing their own products.

Corteva made $420 million on biological products in 2023, the highest revenue among the 5 companies Thomas assessed in the June 30 edition of his weekly newsletter. Syngenta and UPL follow at approximately $400 million. Bayer has invested the most in research and development, spending $2.5 billion in 2023. Sound Ag is the only biological maker that Thomas reports having partnerships with multiple companies (Bayer and Syngenta).

Shane Thomas at Upstream Ag Insights compares major crop protection companies' investments in biological products and forecasted revenue from biologicals. Corteva and FMC have the highest projections with Thomas predicting they'll make $2 billion each on biologicals by 2035 and 2033, respectively.

The USDA Animal and Plant Health Inspection Service plans to request information on options for reducing regulation on modified microbes, which Thomas believes could enable more biological product development by the major crop protection players.

"Companies like Corteva having robust gene editing capabilities," Thomas writes. "Some of these capabilities come from the seed R&D portion of the budget and can be leveraged within the realm of micro-organisms. If there is a reduction in regulatory burden, this could, theoretically, catalyze new product introduction by enabling companies to more readily leverage internal gene editing resources."

Related Content

No-Tillers Twice As Likely to Use Biologicals Compared to General Farm Population

Biologicals Are the Final Frontier of Soil Management

Biologicals: Bugs, Jugs and Waiting for the ‘Arrival Moment’