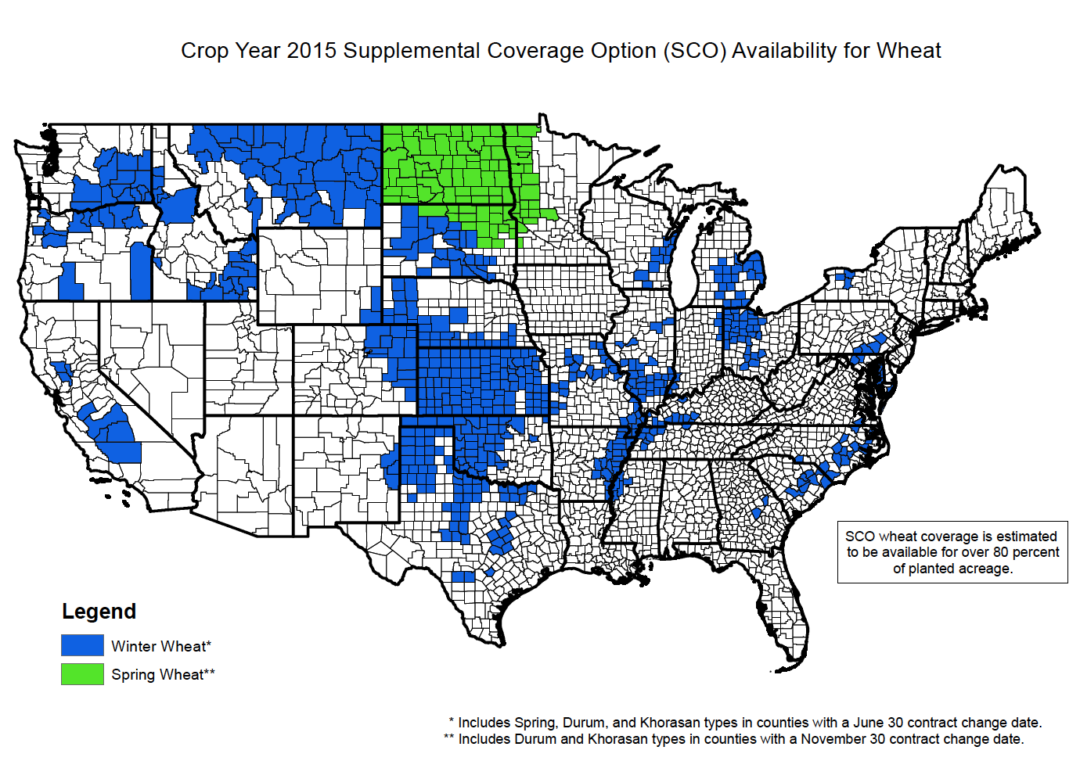

Choosing your crop insurance contract for 2015 just got more complicated with the addition of the Supplemental Coverage Option (SCO), a county-level insurance program available through the 2014 farm bill. SCO will be available in select counties (Figure 1) this fall for 2015 wheat and in more counties in early 2015 for spring-planted crops. SCO works in conjunction with a producer's individual crop insurance policy and is purchased through a crop insurance agent.

Late this year, or possibly in early 2015, landowners will be able to select the farm bill commodity program in which they choose to participate. Landowners will choose if they want their whole farm to participate in a revenue program, Individual Agricultural Risk Coverage (ARC-IC), or if they want to participate on a commodity-by-commodity basis through the County Agricultural Risk Coverage (ARC-CO) or Price Loss Coverage (PLC) with SCO. The sign-up deadline for 2015 SCO winter wheat coverage will occur in advance of other commodity program decisions, complicating the process.

Landowners and tenants intending to plant wheat this fall who have a crop insurance policy and are interested in SCO (SCO enrollment limits other commodity program options to just PLC) need to sign up for 2015 SCO wheat coverage by Sept. 30. For 2015 wheat, because SCO enrollment is happening in advance of other commodity program decisions, farmers will be allowed to withdraw acres enrolled in SCO if they later decide to enroll in either ARC-CO or ARC-IC.

SCO wheat enrollment will only matter on farm numbers where wheat is intended to be planted. Withdrawals of acres from SCO will be allowed until the wheat insurance acreage reporting date, Nov. 15. After this date, producers may still be able to cancel SCO coverage upon choosing ARC-CO or ARC-IC, but can expect a penalty equal to a percentage (we expect 20%) of the SCO premium. Thirty-two counties in Nebraska will have SCO coverage for winter wheat in 2015. SCO will have a premium, which is subsidized 65% by the federal government.

Farm program commodity program choices will lead producers to different programs due to producer specific circumstances. Consequently, it is vitally important to link your farm conditions to perceived program benefits. SCO benefits and costs will vary by producer. Here are some factors to consider when evaluating the benefits of SCO on your wheat acres.

1. Choosing to participate in PLC/SCO over ARC-CO or ARC-IC requires analyzing perceived benefits from all crops grown on that FSA farm number. That is, which program combination will provide the best risk coverage? While current conditions suggest that ARC- CO may look attractive to corn or soybean growers, this may not hold in the case of wheat. Landowners need to evaluate farm programs and insurance for each commodity on each FSA farm number to determine which combinations of insurance and commodity program protection work best.

2. SCO will be more attractive to producers whose planted acres are significantly larger than base acres. SCO benefits are based on planted acres whereas ARC–CO, ARC-IC and PLC payments are based on base acres. For producers with a large number of non-base acres, the PLC/SCO option may provide superior risk coverage.

3. The benefits of SCO will depend on the relationship between county yields and farm yields. Because SCO is based on county-level payment triggers, the farm may suffer a loss when the county doesn't, resulting in no SCO payments. However, the small (14%) SCO deductible makes this scenario less likely than one might initially believe. The 14% SCO deductible makes SCO coverage more sensitive to price and/or yield losses, thereby, lowering the probability for a farm loss and no SCO payment.

A second unusual outcome is that the farm may receive an SCO payment when the farm does not suffer a loss. While possible, this event would be rare. SCO will use the same prices as found in your individual crop insurance policy (that is, the projected price and harvest price). A producer concerned with falling prices can obtain some price protection from SCO.

4. SCO premiums and liability increases as a producer's individual crop insurance coverage level declines. SCO liability is equal to the difference between 86% and the producer-selected coverage level on their individual policy. For example, a grower who selects 75% coverage on their MPCI policy would have an 11% coverage band from SCO (= 86% -75%). Lower individual coverage levels increase SCO liability, which naturally increases SCO premiums.

5. Producers should compare benefits and costs to different coverage levels with and without SCO. SCO could provide more coverage for producers who have historically selected a lower level of individual crop insurance coverage at a cheaper cost than increasing regular crop insurance coverage level. Higher levels of individual coverage may be most attractive if enterprise units are available. Also consider comparing costs and benefits for optional units with SCO costs at varying coverage levels.

6. Identify how much protection your regular crop insurance is offering you. To do this compare Actual Production History (APH) and your expected yield for next year for each field by FSA farm number. Differences in APH and expected yields could likely exist if a series of low yields or high yields were recently experienced or if transitional yields (i.e., county average yields) were recently used to determine APH.

If your APH is quite a bit lower than your expected yield, then crop insurance is only covering a percentage of expected yield. A producer in this situation may consider participating in SCO to provide catastrophic coverage on revenue not protected under regular crop insurance. Catastrophic coverage protects against risks borne at the county level such as drought and heat.

Price protection remains the same at both the county and farm levels. If APH is higher than your expected yield, crop insurance may be providing adequate protection and SCO participation may not be needed. If APH is similar to expected yields, the decision is not as clear.

It appears SCO will be beneficial to producers with FSA farm numbers with certain characteristics. Wheat producers...

• who are uncertain of the benefits from ARC,

• who have low base acres relative to planted acres,

• who are using optional units,

• who have a strong relationship to county yields, or

• whose APH yields are lower than expected yields

…will need to seriously consider the additional protection provided by SCO.

Farm Bill Information

Useful overviews:

Theme Overview: The 2014 Farm bill – An Economic Welfare Disaster or Triumph?

Welfare Effects of PLC, ARC, and SCO

The Base vs. Planted Acre Issue: Perspectives, Trade-offs, and Questions

Also see: