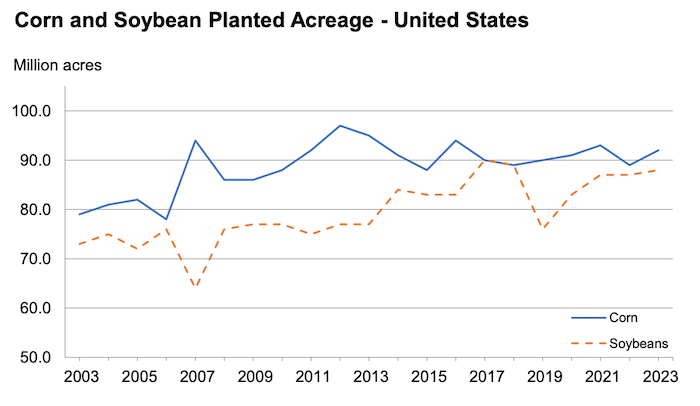

USDA’s March 31 Prospective Plantings report forecasts increases in planted corn and soybean acreages for 2023. USDA's Grain Stocks report, also released March 31, reported year-over-year decreases in corn and soybean stocks vs. 2022.

Acreage Forecasts

Corn planted for all purposes in 2023 is estimated at 92 million acres, up 4% or 3.42 million acres from 2022. Year-over-year, planted corn acreage is expected to be up or unchanged in 40 of the 48 estimating states. This year’s forecasts represent a 1.35% decrease from the 93.3 million acres planted in 2021.

North Dakota’s planted corn acres declined by 1.15 million acres from 2021 to 2022, but corn acres are expected to increase by 800,000 acres in 2023. Acreage increases of 150,000 acres or more from last year are also expected in Illinois, Indiana, Iowa, Kentucky, Minnesota and South Dakota.

Soybean planted acreage for 2023 is estimated at 87.5 million acres, up slightly from last year. Compared with 2022, soybean planted acreage is up or unchanged in 15 of the 29 estimating states. 2023's forecast represents a 0.35% increase from the 87.2 million acres planted in 2021.

Increases of 100,000 acres or more for soybeans are anticipated in Minnesota, North Dakota, South Dakota and Wisconsin. These increases are balanced by decreases of 100,000 acres or more in Arkansas, Indiana, Kansas, Michigan and Missouri. If realized, the planted soybean acreage in Illinois, Nebraska, New York, Ohio and Wisconsin will be the largest on record.

Corn & Soybean Stocks

Grain stocks measure demand for old crops. Corn stocks in all positions on March 1, 2023, totaled 7.40 billion bushels, down 5% from March 1, 2022. Of the total stocks, 4.11 billion bushels were stored on farms, up 1% from 2022. Off-farm stocks, at 3.29 billion bushels, are down 10% from 2022.

Soybeans stored in all positions on March 1, 2023, totaled 1.69 billion bushels, down 13% from March 1, 2022. Soybean stocks stored on farms are estimated at 750 million bushels, down slightly from a year ago. Off-farm stocks, at 936 million bushels, are down 21% from last March.

AgWeb reports the corn and soybean stocks are tighter than expected as of March 1, which could lead to a divide in the corn vs. soybean situation.

"The soybean balance sheet has the potential to get incredibly tight, and the corn situation has the potential to become incredibly loose. But again, that's assuming that these acreage numbers are correct," Joe Vaclavik of Standard Grain tells AgWeb.