Producers should not change their spring planting intentions because of the coronavirus outbreak, according to North Dakota State University Extension crops economist Frayne Olson.

“Don’t change your plans based on what you see in the markets today because it’s not going to be a good reference point,” he says.

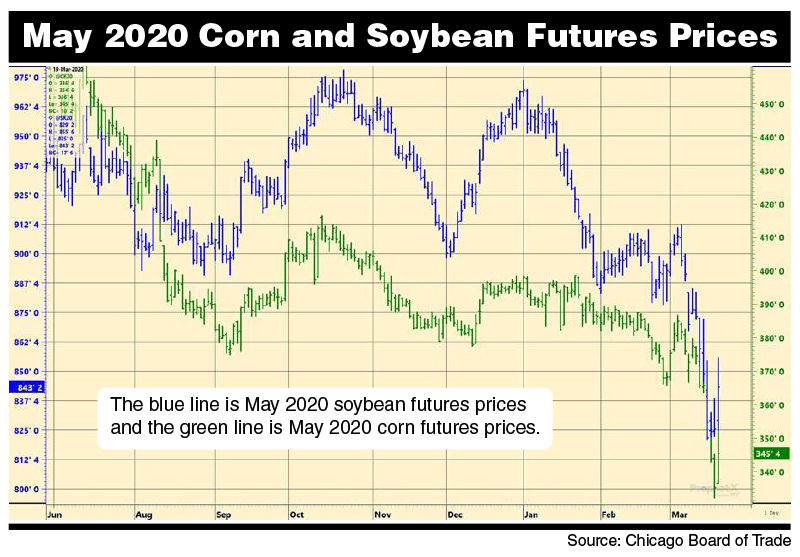

Livestock, grain and energy, mainly oil, prices and the stock market have dropped so dramatically because of the uncertainty surrounding the COVID-19 outbreak, and not because of a supply and demand issue, he notes. This situation is unprecedented, so people don’t know what to expect and tend to think of the worst-case scenario.

“Right now, this is a psychological battle,” Olson says.

The market volatility likely will continue until the number of new cases of COVID-19 in the U.S. starts to decline, he believes. That’s when people will feel that the worst is over. But producers shouldn’t expect conditions to improve quickly.

“It’s still going to be a slow process,” Olson cautions.

Energy and grain prices probably will recover more quickly than livestock prices, he says. Livestock prices likely will rebound more slowly than the other two because of consumer behavior, such as how quickly they are willing to return to eating at restaurants. The stock market will be the last to recover.

In the meantime, despite the low prices, some producers may need to sell grain they have in storage because they need the money or the quality of the grain is deteriorating.

“For those who have to sell, go ahead and sell,” Olson advises.

The lowest risk strategy is to buy a call option if producers want to take advantage when prices start to rebound, he says. However, producers will need to select a broker to work with and set up an account if they don’t already have one. He also recommends producers do a bit of research so they understand call options.